Salary Transfer Letter: Format And Instructions

If you want to take a loan from the bank in UAE, you must provide a salary transfer letter, which is a commitment that the salary you get from your company will directly transfer to the bank.

The salary of the employee would be credited to the bank until the loan is repaid. There is a specific way to write a salary transfer letter. If you read through this article, you will clearly understand the steps and former to write the Letter.

Why Do You Need A Salary Transfer Letter?

Employees must submit a salary transfer letter if they want to take a loan from any bank in the UAE. You have to apply for a salary transfer loan, which is also called the UAE’s personal loan.

If you avail of a salary transfer loan, your salary will be credited to the bank. In the Letter, you have to mention the amount that will be transferred to the bank.

The Letter is issued by your company and contains all the details about the company mentioning that all your payment will be credited to the bank.

Requirements To Avail Salary Transfer Letter:

You have to be above 21 years old. Your salary should be at least AED 5000 to get a loan from a bank. Banks demand a salary certificate as a mandatory document when you want to avail of any loan in UAE.

What Is A Salary Certificate UAE?

A salary certificate is a document that proves your employment and the salary amount provided by your company. You can get it from your employer’s company. The certificate contains necessary details about your company, job, and salary. A salary certificate has many uses in various fields, especially for getting loans and credit cards.

Emirates Nbd Salary Transfer Letter Format:

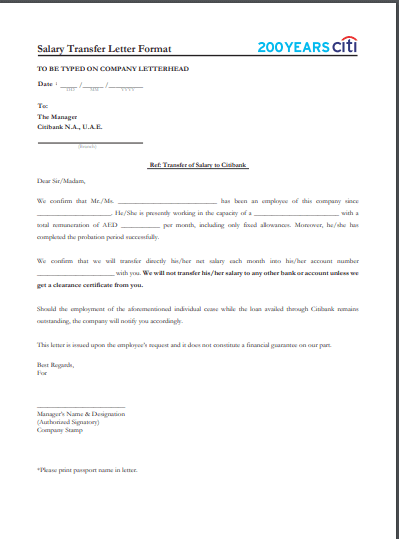

Follow those steps to write a salary transfer letter.

Step 1: Write Letter for salary transfer as a heading.

Step 2: Write to the manager, mention the bank name and address on the left side. Example-

The Manager

xxxxxxxxxxx Bank

Post Office Box xxx

UAE

Step 3: Write the date on the right side, opposite of the address.

Step 4: The Letter is from your company on behalf of you. The first part confirms your identity details, joining date, job details, and mentions that you wish to get a loan from a bank. Look at the pdf for better understanding.

Step 5: The second part informs your salary amount, your account number, and the date until the salary will fully be paid.

Step 6: The third part ensures any event of your registration or termination of a job during the loan; you will notify the bank immediately. And the company will not be responsible for any financial obligation.

Step 7: End the application like this,

For & on behalf of,

Name of signatory

Designation

salary certificate format uae doc pdf here]

Frequently Asked Questions

What is the salary transfer letter?

A salary transfer later agrees that your salary will be directly transferred to the bank when you avail of a loan.

What is the salary certificate?

A salary certificate is a document that proves your employment and the salary amount provided by your company.

How do I write a salary transfer letter?

The process is shown above.