How to Check FAB Bank Statement

Keeping track of your finances is a crucial part of modern life, and one of the easiest ways to stay on top of your money is by regularly checking your bank statements. If you’re banking with First Abu Dhabi Bank (FAB), you’re in luck. FAB offers several convenient, secure, and flexible methods to access your account statements, whether you prefer digital solutions or more traditional ways. In this detailed guide, we will walk you through every available method so you can easily view, download, or print your FAB bank statement whenever you need it. Whether you’re checking monthly spending, confirming salary credits, or preparing for a loan application, accessing your bank statement has never been simpler.

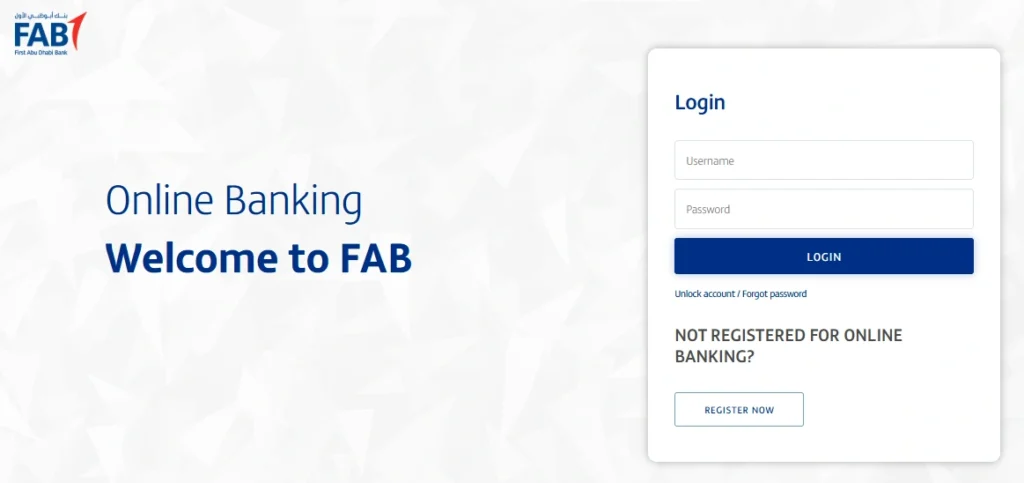

1. Checking Your FAB Bank Statement via Online Banking

FAB’s online banking portal provides a secure, easy-to-navigate platform that allows you to view your account statements from anywhere.

Step-by-Step Instructions:

Login to Online Banking: Visit the official FAB online banking portal. Log in using your Customer ID or card number and your secure password. For added security, FAB might send you a One-Time Password (OTP) to verify your identity.

Navigate to the ‘Accounts’ Section: Once logged in, find the ‘Accounts’ tab. Click on it to access a detailed view of all your linked accounts.

Select ‘Statements’: Choose the specific account for which you want to view the statement. Under account options, click on ‘Statements’.

Choose the Time Period: Select the month or the range of months you wish to review. FAB usually allows you to download statements up to the last 12 months online.

Download the Statement: Once the statement is displayed, you can view it directly or download it in PDF format for your records. The statement will show a detailed breakdown of credits, debits, transfers, and balances.

Pro Tip: If you require a statement older than 12 months, you might need to submit a request via online banking or visit a branch.

You can also use your prepaid card to check your FAB Balance Enquiry online.

2. Viewing Your FAB Bank Statement Using the Mobile App

FAB’s Mobile App is a powerful tool that puts your financial information at your fingertips, perfect for busy individuals on the go.

Step-by-Step Instructions:

Install the FAB Mobile App: Download the official FAB Mobile App from your device’s app store (available on Android and iOS).

Login Securely: Use your banking credentials, fingerprint ID, or facial recognition to log into the app securely.

Access Your Account: Tap on the ‘Accounts’ section, where you’ll see all your active accounts listed.

Choose ‘Statements’: Select the account you are interested in and look for the option labeled ‘Statements’ or ‘Account History’.

Download or Email the Statement: You can view the statement right away or download it as a PDF. Some users also have the option to email the statement to themselves directly from the app.

Note: The app also allows you to request official stamped statements, useful for visa applications, loan processing, and other formal needs.

3. Requesting Your FAB Bank Statement via Email

If you prefer to receive your statement in your inbox without logging into apps or websites, FAB makes this process smooth.

How It Works:

Send a Request: From your registered email address (the one linked to your bank account), you can send a formal email request to the customer service address.

Provide Necessary Details: In your email, clearly mention your full name, account number (partially masked for safety), and the statement period you need.

Receive a Secure PDF: FAB will send you an encrypted PDF containing your statement. You will need a password to open the document, ensuring your financial information remains private.

Password Tip: Typically, the password is a combination of the last four digits of your account number and your birth date in DDMM format.

4. Getting a Mini Statement from an ATM

For those who prefer a quick overview without accessing digital platforms, FAB ATMs offer an instant solution.

Step-by-Step Instructions:

Visit an FAB ATM: Find a nearby FAB ATM at a mall, metro station, or branch.

Insert Your Debit Card: Enter your card and securely type in your PIN.

Choose ‘Mini Statement’ Option: From the menu, select ‘Account Services’ and then tap on ‘Mini Statement’.

Print or View Transactions: The ATM will display or print a slip showing your most recent transactions. This is ideal for quickly checking recent activity, like salary credits or card payments.

Important: A mini statement only covers recent transactions (typically the last 5 to 10), not a full, detailed monthly statement.

FAQs

Q1. Can I get a stamped bank statement online?

Yes, using the FAB Mobile App or Online Banking, you can often request a digitally stamped statement suitable for official purposes.

Q2. How far back can I access statements online?

Typically, FAB allows you to access up to 12 months of past statements online. For older records, you might need to submit a special request.

Q3. Is there a fee for getting my bank statement?

Viewing or downloading your FAB statements via online banking or the app is usually free. However, requesting printed statements from a branch might incur a nominal fee.

Q4. What should I do if I forget the password for my emailed statement?

The password format is usually predictable (last 4 digits of account number + birth date in DDMM format). If it still doesn’t work, contact FAB customer service for help.

Q5. Can I check my FAB credit card statement the same way?

Yes, credit card statements can also be accessed through FAB Online Banking and the Mobile App, following similar steps.

Conclusion

Managing your finances starts with knowing where your money is going, and accessing your bank statement is a simple yet powerful way to stay informed. Whether you prefer logging in via desktop, using a mobile app on the move, requesting it by email, or grabbing a mini-statement at an ATM, FAB offers multiple options tailored to your needs. By regularly checking your bank statements, you can track expenses, spot any suspicious activity early, and plan your future with confidence. Take advantage of these easy tools that FAB provides and ensure that you always have full control over your financial life.